5 High Growth DTC Brands That Are Shaking Up the CPG Space

Bhaskar Sarma

Writer

When the DTC phenomenon exploded, the CPG (Consumer Packaged Goods) was a hot niche: after all, CPG contributed to 10% of US GDP.

During the first wave of DTC, hundreds of brands sprouted up in the CPG space and disrupted the market. The industry behemoths — Pepsico, Unilever, Mars, etc — had a harder time with DTC and struggled with issues like unit economics, customer acquisition, retention, and logistics/last mile delivery.

But the disrupters are now getting disrupted by the big boys, and consumers no longer think they are special.

According to the 2022 DTC Consumer Purchase Index report:

- 79% of consumers planned to buy at least once from DTC brands in 2020. This number fell to 69% in 2021.

- The percentage of consumers who bought at least once from DTC brands fell from 70% in 2020 to 60% in 2021.

- Only 17% of consumers thought that DTC brands could give them something traditional retailers couldn’t.

However, amidst the chaos, some DTC brands are flourishing.

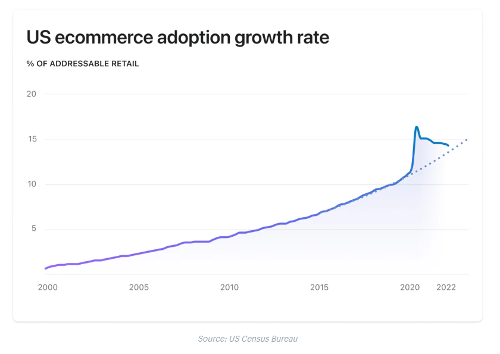

What’s more, they are redefining what CPG DTC growth might look like in a more volatile world where the eCommerce adoption rate is falling from pre- pandemic heights.

Read on to find out how the Davids in the world of CPG DTC are still prevailing over the Goliaths.

1. Olipop

Sodas have a deserved reputation for being unhealthy and have been blamed for issues like obesity, rotting teeth, asthma, etc.

So when Olipop launched itself as a functional soda, it took a calculated risk.

Because Olipop is essentially a health drink aimed at improving gut health with the same kind of nutritional outcomes as the likes of kombucha.

Each can contains between 2-5 gms of sugar (compared to 30-35 gms of sugar in normal sodas), along with other botanicals.

But the kombucha market is essentially less than $5bn.

However, the soda market is much bigger at $40bn and Olipop calling itself a “functional soda brand” helped it get into the much bigger soda section in Target, Kroger, Whole Foods, 7-Eleven, Safeway, Wegmans, etc.

And that positioning has worked wonders for Olipop and clicked with customers.

- Founded in 2018, Olipop recorded $35k/month in eCommerce sales in Feb 2020. That number became $1mn+ by Jul 2021 and the brand wants to increase its run rate to $100mn by 2022.

- They are estimated to be present in 8,000-10,000 store locations by end of 2021.

- Most customers buy directly from their website, through email and SMS, but many also buy through Amazon.

Much of this growth is driven by excellent content marketing including earned media (appearance in a Discovery+ documentary or a mobile game).

Olipop features a lot of medical research on gut health, brain function, immunity, etc on its blogs to build credibility around its product.

It hasn’t shied away from innovative marketing campaigns, like jumping in on the limited edition sodas released in collaboration with the Minions movie(which sold out soon).

#ad Taste test of the @drinkolipop x @Minions Banana Cream Soda (spoiler alert: I LOVED IT!!!) 🍌🥤 Use the link here to get $15 off your next OLIPOP order: https://t.co/sa3g1WPjKn pic.twitter.com/l2oH1twzEj

— Kennedy Womack (@Kennedy__Womack) July 16, 2022

For Olipop, subverting expectations around soda with proven health benefits has been extremely lucrative.

2. NUGGS (Simulate)

What happens if you apply the principles of software development to creating hyper-realistic alternate chicken nuggets?

You get NUGGS, who unironically call themselves the Tesla of Chicken.

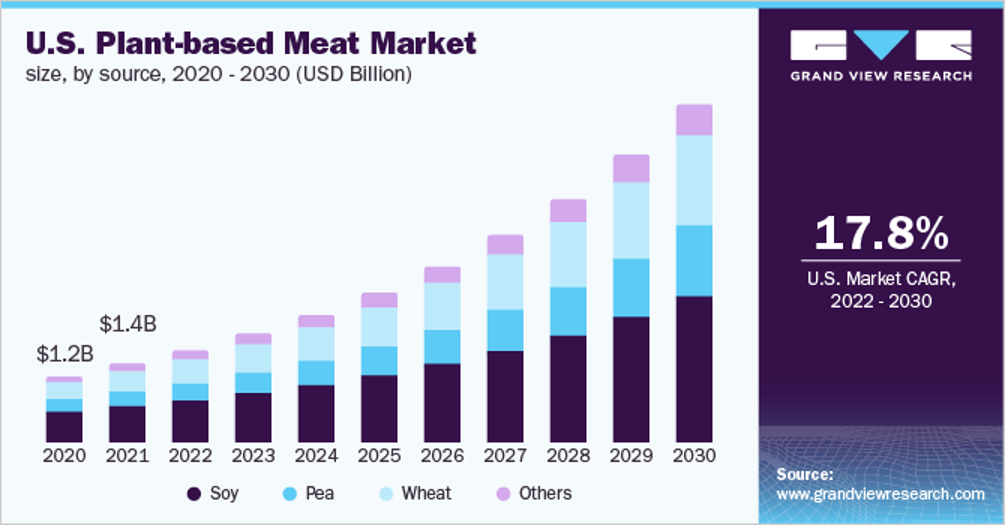

Simulate, the company that started with plant-based chicken nuggets has been one of the stars in the fast-growing plant-based meat market worth $1.4bn in 2021.

NUGGS often goes viral on social media because of stunts like the flying chicken while a lot of their social media marketing is all dank memes.

While their product packaging is dripping with dark humor, the product page copy is heavily influenced by tech products.

But they gained loyal customers, because the product tasted like real chicken, and not heavily processed goop.

This Glamour review gets to the heart of why NUGGS has so many fans:

In the past when I’ve tried a meat alternative, the flavor and texture would low-key remind me of the spongelike “meat” you’d find in a microwave dinner from the ’90s…Nuggs…focuses on what it does offer consumers: a tasty-as-hell alternative with more protein and less fat than traditional nuggets.

Creating a product that’s aimed not just at vegans and vegetarians looking for a chicken substitute, and being self-aware enough not to preach about saving the environment has been one of the major reasons behind Simulate’s enduring brand appeal.

3. Grove Collaborative

Grove Collaborative, a certified B Corp, wants to get rid of plastic.

The natural household and personal care brand claims to be plastic neutral already and aims to be completely plastic-free by 2025.

Founded in 2012, Grove had a $1.5bn IPO last year and is now a part of the Virgin group.

Grove walks the talk on plastic reduction and sustainability in different ways:

- It eschews commonly used ingredients for soaps, cleaning and beauty products like ammonia, chlorine, and phosphates. All ingredients are plant-based and organic.

- It ships concentrates and uses glass and aluminum instead of plastic to reduce packaging waste.

- It imposes minimum order limits and doesn’t ship single-order packages.

Along with product design, it also does a lot of community-driven work like organizing plastic clean-ups.

Clean up with us! 💚 Tell us one way you're going to reduce single-use plastic this July, and for every comment, we'll remove a pound of plastic from nature with help from @repurpose_global. 🌎

— Grove Collaborative (@grovecollab) July 19, 2022

.

.

.

.

.

.

#plasticfreejuly #peaceoutplastic #beyondplastic #grovecollaborative pic.twitter.com/iybw0FgDKc

Grove’s growth has of late been muted but it’s continuing its retail expansion and will be present in Target, Kohl’s, and two other retailers nationwide.

Grove’s experience shows that if brands can maintain a credible narrative around a particular cause, they can hit impressive numbers.

4. Liquid Death

Would drinking water ever look cooler than drinking alcohol?

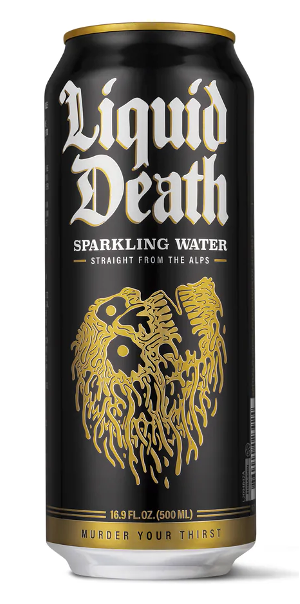

With Liquid Death, you will come off looking like a death metal fan and will still be able to drive your friends home after the concert, because your can will look like this:

LD is a cult DTC brand that regularly goes viral because of its wacky ads, like this one featuring a rotund comedian best known for joking about Russian mobsters.

Have you always dreamed of having a body just like @bertkreischer? Now it’s time to turn your dreams into reality. Introducing Body By Bert. Stream the full 10-minute workout video free: https://t.co/ksFED9kde4#liquiddeath pic.twitter.com/tvqs1fp2h9

— Liquid Death Mountain Water (@LiquidDeath) July 19, 2022

Like Grove Collaborative, Liquid Death is also focused on getting rid of plastic, but they talk about it in a very different way.

Liquid Death’s edgy aesthetic isn’t merely a marketing ploy. Sample some of the comments under a video talking about Liquid Death which highlights why the product has been such a draw.

Some stats show how much LD has been killing it since it was launched in 2019:

- It is already available in 29,000 stores including chains like 7-11, Whole Foods, and Safeway.

- It sold $3mn worth of merchandise in 2021 (50% of customers buy merch).

- It has 200,000 early access members who are eligible for exclusive perks.

Another sign of just how aligned Liquid Death is with the zeitgeist? Check out this post by the brand’s CEO.

Drinking water never looked this cool.

5. Milk Bar

Milk Bar started in 2008 as a small New York cake and pastry brand with some unique recipes.

Cut to 2022, and it’s now a major DTC brand and the founder has her own Netflix show. It also delivers anywhere in the US and is available in 5,500 grocery stores.

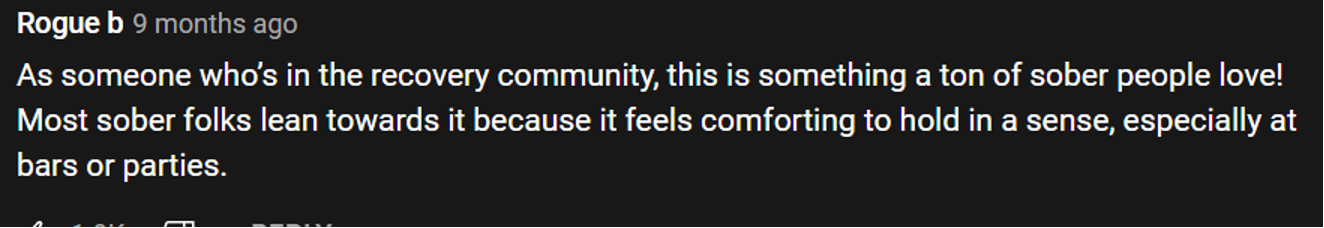

Milk Bar doesn’t just want to sell you cakes.

They also want you to be a better baker and offer in-person public and private baking classes at select locations.

They can also teach you how to be a baker in 30 days through an online course.

And if you prefer not to pay, you can always watch the founder on Instagram showing off her skills.

Milk Bar’s growth isn’t just based on their very popular and award-winning cake and dessert designs.

They have built a very attractive rewards program that also incentivizes UGC, reviews and referrals.

They have also leveraged collaborations with celebrities and brands to expand their footprint.

- The Milk Bar founder hand-baked an one-time batch of 100 cookies for M&M to promote a new M&M product line.

- Pop superstar Mariah Carey launched a limited edition cake during the 2021 holiday season, available only through the Milk Bar website.

- Milk Bar teamed up with Apple TV+ and Postmates to offer a range of biscuits prominently featured in a TV show in NYC and LA. It also created limited edition shakes and cakes in collaboration with Shake Shack.

These collabs and team-ups, along with their recipes, probably helped them land up in Fast Company’s World Most Innovative Company list.

We were named one of Fast Company's World's Most Innovative Companies this year! 💪🤯🏆 13 years in, and dreaming bigger and bolder than ever before. Thank you for being along for the ride! 🍪🛒#FCMostInnovativehttps://t.co/5ICA2y0VPt pic.twitter.com/y7nNOY5mkh

— Milk Bar (@milkbarstore) March 17, 2022

DTC brands in the food and beverage space should take a leaf out of Milk Bar’s education and collaboration handbook to create brand awareness and brand advocates without splurging on expensive paid marketing.

Conclusion

All five brands featured in this post have built significant storytelling chops, but there are other factors contributing to their growth.

Previously, we had written on the secrets propelling high-growth fashion, footwear and beauty DTC brands and some of those trends are common for our featured brands too:

- Innovate for product and logistics (including content logistics).

- Entertain and educate. Do both, across owned and earned spaces.

- Embrace collaboration and influencers, but selectively.

If DTC success was hard in 2021, it’s going to be harder in 2022.

But innovation, customer relationships, and a keen eye for shifts in market behavior can help you put your brand on track to high growth.

See how brands use Talkoot's AI to drive conversion.

Book a demo >

See how leading brands are using Talkoot to increase conversion and get product content to market faster.

Book a demo >

See how leading brands are using Talkoot to increase conversion and get product content to market faster.

Book a demo >

See how leading brands are using Talkoot to increase conversion and get product content to market faster.

Book a demo >