Fashion, Footwear and Beauty: Three D2C Winners

Bhaskar Sarma

Writer

What are the top DTC brands in fashion, beauty, and footwear categories, and how do they manage to keep their product story straight?

This article seeks to answer the second question by analyzing the top 3 brands from the widely referred and regularly updated 2 PM DTC Power List (paywall).

In case you are not a 2PM member, here’s how brands are ranked:

(Brands) are ranked based on internal data, employment, funding, Charm.io data, and estimations. Dying brands will eventually be jettisoned from the list.

The Charm.io Growth Score is a multi-dimensional scoring algorithm that is indicative of a brand’s growth trajectory. Charm rolls signals up into an algorithm that determines a rank on a percentile basis.

The Charm.io Success Score is a score that measures the longer-term viability of the brand in question. It serves as a historical performance marker in brand equity and sales over time

From the list (as of 9th July), the top 3 brands are:

- Fashion Nova (List Rank #1, Fashion)

- Allbirds (List Rank #14, Footwear)

- Snow (List Rank #4, Cosmetics and Beauty)

Fashion Nova and Allbirds need no introduction and have been on the list for quite some time.

Snow, which sells DIY teeth whitening kits, is a relatively obscure brand and a newer member. However, it has beaten storied beauty DTC brands and is placed within the top 5 DTC brands overall, which makes it interesting.

We will be looking at each brand mainly from the context of how it presents product information on its website and product pages.

To give you more context, we will also look at how that is woven with its brand and marketing strategy on other channels like email and social media.

1. Fashion Nova: Community Conquistador

Fashion Nova is probably the first fashion brand to leverage the impact of Instagram and grow at an explosive pace.

The brand’s business model hinges on working with thousands of micro and nano influencers to create demand for trendy outfits straight out of paparazzi photos, but with an average MSRP of $20-30.

It’s no wonder that when Cardi B, who began working with FN before she became an A-lister, released a custom collection, it sold out within 82 minutes.

But FN isn’t actually known for original designs.

Instead, they have grabbed attention for copying celebrity outfits and releasing an affordable version on their website within hours.

The community also plays an intrinsic role in growth: thousands of #novababes and Novapartners (on Youtube) provide the brand with a steady stream of user-generated content, and new product ideas to boot.

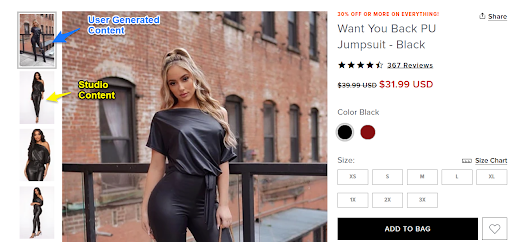

A lot of that content often gets highlighted on the brand’s product page and the official Instagram feed.

And because FN worked with so many influencers, they were one of the first major brands to create designs for all body types, with an entire section on their site called Fashion Nova Curve.

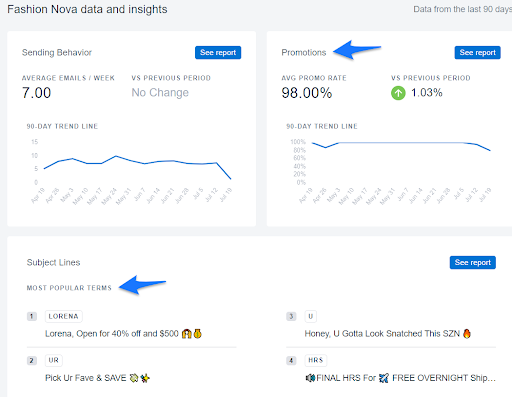

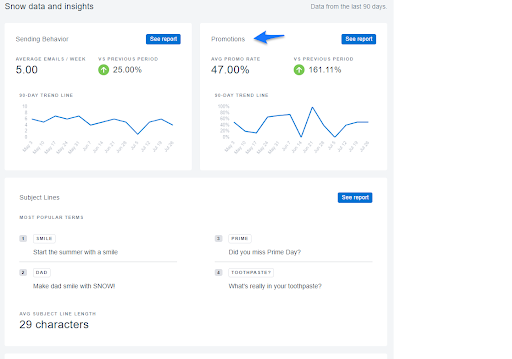

Since FN releases hundreds of new designs every day, there’s always a sale on the site: this trend is reflected in their email marketing which has a 98% promo rate (data from Mailcharts).

Fashion Nova’s brand story is about creating a wide selection of sexy and aspirational outfits that even a broke student can wear and look good in.

They are a member of the ultra-fast fashion category, now shared by other brands like Shein and Asos. It’s a tough category to be in, and holding on to the top spot depends on how much excitement brands can keep on generating about new products and collections.

While this category faces a lot of blowback over sustainability concerns, the pandemic has not slowed down sales: on average, Americans buy a piece of clothing once every five days.

Behind the scenes of the product story

Since fast fashion relies on visual content and rapid turnaround times, the backend operations of a fast-fashion brand require plenty of investment in systems, processes, and technology for eCommerce teams to push out >100 new product pages every day.

Here are some of the challenges to consider for these brands:

- Collating product information from 1000s of manufacturers and presenting the right product information with the right product.

- Co-relating UGC for respective SKUs and featuring them accurately on the product page.

- Ensuring that collections, themes, and promotions have the right content.

- Refreshing content for older SKUs/campaigns according to rapidly changing trends

- Passing on customer feedback to the product team, and incorporating voice of customer language in product content.

Traditional tools like spreadsheets can’t keep up with the requirements of a fast or ultra-fast fashion brand in the context of organizing product content because they don’t offer features like:

- Project management

- Fine-grained access controls

- Sophisticated find-and-replace

- Automated workflows

- Integration with third-party channels like Amazon.

Talkoot solves for all these use cases, and more: we did a whole blog post covering the product information requirements of high growth DTC brands that can support even ultra-fast fashion brands.

2. Allbirds: Green Guardian

Allbirds is the #1 footwear brand on the DTC Power List, and it has a completely opposite brand ethos compared to Fashion Nova.

It has a much smaller product line. Its operations are carbon-neutral and its sneakers are favored by the likes of Barack Obama, Matthew McConaughey, Mila Kunis, and a whole host of celebrities and Silicon Valley types.

However, because a typical pair of Allbirds retail for under $100, they are eagerly snapped up by millions of consumers looking for comfortable footwear options (environmental friendliness is the icing on the cake).

Unlike the vast majority of DTC brands, Allbirds has always been profitable and is valued at $1.7bn.

Born out of a Kickstarter campaign in 2016, Allbirds started with a single product: sneakers made of merino wool.

It soon created proprietary materials like:

- TENCEL™ Lyocell, sourced from wood.

- SweetFoam, sourced from sugarcane.

- Trino, sourced from a mix of Eucalyptus wood fibers and merino wool.

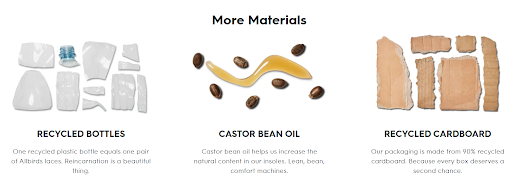

It also uses plastic bottles, cardboard, and castor oil to reduce the carbon footprint of its sneakers.

It holds 14 patents on sustainable materials engineering and has collaborated with Adidas to build the world’s most sustainable shoe.

But Allbirds wants to play in a much larger space beyond footwear or fashion. It wants to license its proprietary technology to other companies, helping them design more sustainable products.

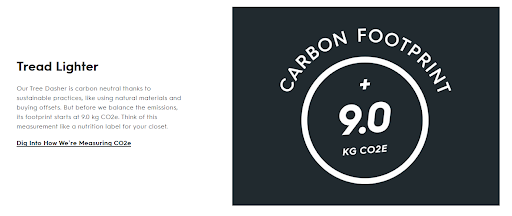

It has already taken steps in this direction by releasing an internal calculator used to measure the carbon footprint of every product throughout the complete lifecycle.

Behind the scenes of the product story

In terms of telling the brand story, its product pages show an attention to detail missing in the vast majority of eCommerce brands.

Because the brand lives and breathes sustainability, it incorporates different elements in the description of the product, rather than relegating the information as an afterthought.

Here’s a typical Allbirds product page.

As you can see, the page has a lot of educational content highlighting the different features of the shoe.

Because so much of this content is technical, it requires the involvement of subject matter experts in the product page creation process.

With a typical tool like a spreadsheet, it becomes impossible to manage the workflow between different teams, especially when the content needs to be fact-checked and approved at multiple levels before it goes live.

With a modern PIM like Talkoot though, creating this kind of content is not only easier because it acts as a content studio, but teams can save time by easily reusing technical content, among other things.

3. Snow: DIY Dentistry

The last brand on our list is the top beauty brand in the 2 PM list, but with a twist: Snow is all about glamming up your teeth and making you look good on your Zoom calls and dates.

While Snow has been around since 2016, the pandemic provided a massive growth boost, as people were unable to visit their dentists but still needed their teeth whitened.

This excerpt from an article in Health has more details on how the product works:

The system is equipped with four whitening wands (three regular ones and one extra-strength pen) and a USB-powered LED device. The whitening serum contains hydrogen peroxide—a whitening ingredient that’s been proven successful at whitening and removing stains from teeth—and is vegan, gluten-free, and cruelty-free. Also worth noting: The gel formula was designed to be safe for sensitive teeth, so you don’t have to worry about discomfort, pain, or raw or peeling gums during or after treatment.

One reviewer said: “I hated my yellow teeth and the Dentist charges $400 for whitening. I wanted something that was easy to use at home and at a lower cost. This works!!!!!! Within a week I noticed my teeth looked whiter! And now, almost a month later my teeth are noticeably whiter! I never had any sensitivity either.”

In terms of customer acceptance Snow:

- Says it has more than 500,000 customers

- Shows 6455 5 star reviews on the website

- Claims that “97% see results after just one use (consumer study) and 100% after 21 days.”

It also seems to be a hit on Amazon and is rated at 4.4 out of 5.

Snow’s value proposition is simple: instead of paying your dentist $400-$600/appointment for teeth whitening, you will spend only around $2 or so in a 30 minutes long DIY teeth-whitening session in the comfort of your home.

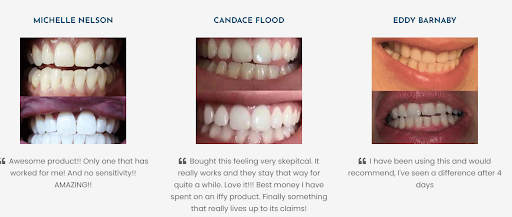

Since these are bold claims, Snow needs to provide a lot of proof to back them up.

Behind the scenes of the product story

One of the ways it has done that is by investing heavily in before and after user-generated photos, giving people the confidence to try the product out.

In its early days (2018-19 ) Snow has also used celebrity endorsements from the likes of Floyd Mayweather to drive more sales and generate credibility.

Kris Jenner showed off the product in an unboxing video, no doubt driving plenty of attention and user interest.

Unlike a traditional skincare or beauty brand, Snow invests heavily in education, because their unknown and relatively high sticker price product faces off against several well-known competitors– dentists, teeth whitening creams, cheap hydrogen peroxide, etc.

Hence its product pages look less like a typical eCommerce page and more like a long-form landing page.

It also displays social proof to persuade skeptical people about the brand’s “too good to be true” claim.

On Youtube, its channel features plenty of user reviews and tutorials.

Snow’s education-focused approach is also reflected in email. Unlike Fashion Nova, its email strategy is not skewed towards promotions and sales (98% vs 47%).

This approach seems to be working. Snow’s sales numbers – $100 mn in revenue in 5 years- are extremely impressive.

It has also done well with paid social, selling out its Black Friday inventory.

With about 10 products on its inventory, Snow is a far cry from the likes of Fashion Nova, or even Allbirds, in terms of the complexity involved in managing product content and brand narrative.

Smaller brands like Snow can actually get by using traditional tools like spreadsheets to manage product content.

However, as information consistency demands increase, smaller teams can save plenty of time and set themselves up for seamless scaling if they were to deploy a copy studio + PIM tool like Talkoot to create and push product content across multiple channels.

Also, while Snow needs deep product information because of the nature of its product, the days of a cursory product page are long past.

Conclusion

This article covered three completely different DTC companies in terms of niche, size, and price points in comparison to the competition.

Fashion Nova sells cheap yet sexy apparel and relies on supply chain prowess, gargantuan inventory, and an army of micro and nano influencers to push sales.

Allbirds is a materials engineering brand that mostly sells comfortable and affordable footwear. It has taken advantage of increased interest in athleisure and sustainability and is one of the rare brands to become profitable.

Snow is a much smaller DTC beauty brand with limited products and an extremely narrow focus- make tooth whitening cheap, easy, and as convenient as possible.

However, there’s one common thread- all three brands place a lot of emphasis on product content, either in the form of text or visual media.

With most products themselves becoming commoditized, product pages will become content heavy and start to resemble the likes of Snow or Allbirds, so that the brand can be distinguished from the competition.

Managing that constant flow of content, and using it to get users and customers excited to form a viable community is how DTC brands can grow in a post iOS14 and iOS15 world where 3rd party user data is no longer reliable.

Here’s how Fashion Nova’s operating model works, according to CEO Richard Saghian:

Fashion Nova works with over 1,000 manufacturers, including those based in Los Angeles, which results in samples of designs being ready within just 24 hours. Then, 48 hours later, the 600 new products that are released each week are photographed. These are shared online one to two weeks after conception, and the items tend to sell out in days or even hours.